Tax Reforms and Life Settlements

Recent reforms have helped increase the popularity of life settlements, since changes to the tax code make it a more favorable option for seniors looking to convert a life insurance policy. Specifically, the March 2018 tax bill included several provisions that should change the way consumers view a potential life settlement, including:

Magna Life Settlements Overview

Reduction of Taxes on Life Settlements

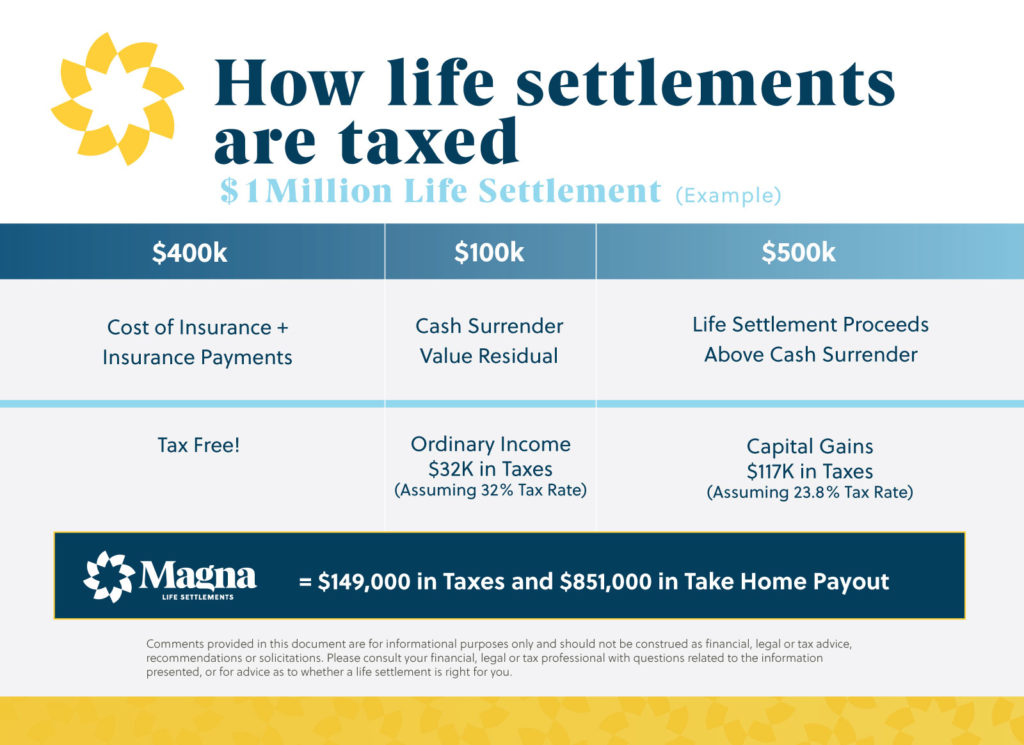

By allowing all premiums paid to be included as the tax basis, the new tax code evens out the fluctuations in determining the tax basis for a life insurance policy. Essentially, this provision allows a life settlement and the surrender of a life insurance policy to be treated equally from a tax perspective.

More generous exemption from estate tax

The amount of money exempt from the estate tax — previously set at $5.49 million for individuals and $10.98 million for married couples — has been doubled. Now less than 0.1 percent of all estates are expected to be subject to estate tax. This change means that many policy owners now recognize their modest estate no longer requires the tax planning provisions offered by their life insurance policy.

New tax credit for non-child dependents

Taxpayers may now claim a $500 temporary credit for non-child dependents. This can apply to a number of people who adults may support, such as elderly parents, easing the tax burden on caregivers.

Higher deduction of medical expenses

For the next two years, filers can deduct medical expenses that add up to more than 7.5 percent of adjusted gross income, as opposed to the previous threshold of 10 percent. The increase in medical deductions could lead individuals to incur more medical expenses, and those costs are often paid from proceeds of a life settlement.

More government protection

Seniors considering life settlements can take comfort from more favorable tax policies as well as emerging legislation requiring disclosure of the life settlement option and otherwise protecting consumers in the market. Forty-three states currently have passed consumer protection regulations, and such laws are under consideration in other states.

Knowledge is power when deciding how to make the most of an unwanted life insurance policy, and companies like Magna Life Settlements are committed to making sure accurate information is available for those considering life settlements. With an assortment of favorable new tax provisions and a growing understanding of the benefits of settlements, seniors are better positioned than ever to make this financial decision for their retirement years.

Magna Life Settlements, Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Sources:

P.L. 115-97, Section 13521(a) – By Gary A. Forster, J.D., LL.M., managing partner, and Paige L. Minch, J.D., attorney, both at Forster Boughman Lefkowitz & Lowe in Maitland, Fla.