Vibrant Outlook for Life Settlements Catalyzed by 4 Tax Reform Provisions

We’re all now aware that recent tax reform law is the first major tax overhaul since 1986 when Ronald Reagan was President. Noteworthy provisions: the standard deduction has doubled, tax rates are lowered and fewer people deal with the alternative minimum tax. None of this will likely affect 2017 taxes. However, four less-publicized tax reform elements will encourage life settlement growth in an already robust environment.

Magna Life Settlements Overview

Taxes on a life settlement will reduce

The new law simplifies and reduces taxes by allowing all premiums paid to be included as the cost basis. The previously unfavorable 2009-13 ruling required sellers to remove the cost of insurance (COI) from their premiums when calculating the cost basis. This not only increased tax due, but also made it very difficult to determine a policy’s COI.

Majority of Americans Exempt from Estate tax

Before tax reform, few estates were subject to the estate tax, which applies to the transfer of property after someone dies. Now, even fewer people have to deal with it. The amount of money exempt from the tax — previously set at $5.49 million for individuals, and at $10.98 million for married couples — has been doubled. Now less than 0.1% of all estates are expected to be subject to estate tax.

New Tax Credit for non-child Dependents

Taxpayers may now claim a $500 temporary credit for non-child dependents. This can apply to a number of people adults support, such as elderly parents.

More Medical Expenses can be Deducted

For the next two years, filers can deduct medical expenses that add up to more than 7.5% of adjusted gross income. In the past, the threshold for most Americans was 10% of adjusted gross income.

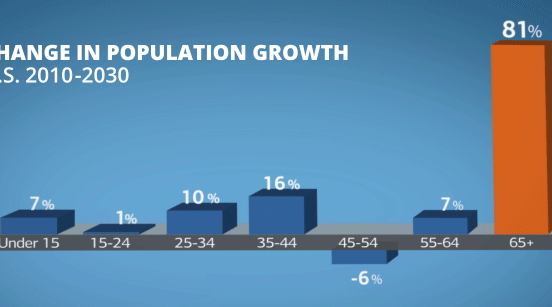

A life settlement is the sale of a life insurance policy for a value in excess of the policy’s cash surrender value, but less than its face value, or death benefit. A policy owner receives a cash payment, while the purchaser of the policy assumes all future premium payments and receives the death benefit upon the death of the insured. According to the Life Insurance Settlement Association (LISA), “An astounding $100 billion+ in face value of life insurance is lapsed or voluntarily surrendered each year by seniors over the age of 65.”

Obviously, paying less tax on a settlement will make it more attractive under the new tax reform, but we expect the other elements mentioned to also encourage policy owners and their advisors to actively consider life settlement options.

With respect to the estate tax exemption, many policy owners now recognize their modest estate no longer requires the tax planning provisions offered by their life insurance policy. For caregivers, the tax credit is likely to encourage more financial understanding of their elderly parents’ finances and the options life settlement affords them. Lastly, more medical deductions may incur more medical expenses which are often paid from proceeds of a life settlement.

Magna believes there is a tremendous opportunity to increase awareness, especially in light of the recent tax reform law increasing the federal estate tax exemption, which may eliminate the need for many policies purchased as an estate planning tool. In those cases, a life settlement may be a reasonable financial planning option.

David Serra, President of Magna Life Settlements said of the reform, “Policy owners are rapidly recognizing life settlements as a compelling alternative to surrendering unwanted life insurance policies. Now more than ever, there is a tremendous opportunity to increase awareness so that the potential untapped value of an unneeded life insurance policy can be maximized, especially in light of the recent tax reform law.”

About Magna Life Settlements and Vida Capital Management

Magna Life Settlements has been active in the life settlement industry since 2004 and was acquired by Vida Capital Inc. in 2010. Headquartered in Austin, TX, Vida Capital is an institutional asset manager with over $2.6 billion of assets under management focused exclusively on providing longevity-contingent investment solutions to institutions and individual investors. Vida specializes in the structuring, servicing, financing, and management of life settlements, synthetic products, annuities, notes, and structured settlements. Vida’s senior management team has over 100 years of life settlements and life insurance experience and extensive knowledge of alternative investing. For more information, please visit http://vidacapitalinc.com.

Clay Gibson, Managing Director, Policy Origination

[email protected]

1-888-996-2475